Selling your life insurance policy, whether through a life settlement or a viatical settlement, can provide much-needed liquidity for policy owners who no longer need their coverage. Choosing the right company is critical to maximizing your policy’s value and ensuring a smooth, transparent process. Here’s a guide to finding the best company to sell your life insurance policy to.

1. Use a Licensed Life Settlement Provider

A life settlement provider is a licensed company that directly buys your policy or works with institutional investors to purchase it. These companies handle the underwriting, offer-making, and eventual purchase of your policy.

Top Life Settlement Providers

- Coventry Direct: A leading provider known for its strong market presence and competitive offers.

- Magna Life Settlements: Offers personalized service with a focus on policyholder needs.

- Abacus Life: Known for fast processing and transparency in the settlement process.

- GWG Life: Specializes in helping seniors unlock their policy’s value.

When working with a provider, ensure they are licensed in your state and have a strong reputation for fair offers and transparent processes.

2. Work With a Life Settlement Broker

A broker acts as your representative, shopping your policy to multiple settlement providers to generate competition and secure the best offer. While brokers charge a commission, the added competition often results in higher overall payouts.

Top Life Settlement Brokers

- Rapid Life Settlements: A trusted name in the industry, offering in-depth market expertise and utilizes LS Hub technology.

- Policy Settlement Group: Known for client-focused service and comprehensive market outreach.

- Settlement Capital: Provides tailored solutions for complex settlement needs.

Brokers are especially useful if your policy has unique features or if you’re unsure how to navigate the market.

3. Consider Platforms for Maximum Value

Technology-powered platforms connect policy owners directly with a wide network of buyers, including institutional investors. This approach maximizes competition and simplifies the process.

Key Benefits of Platforms

- Global Buyer Network: Increased competition leads to better offers.

- Streamlined Process: Technology automates and expedites underwriting and offers.

- Transparency: Platforms often have clear fee structures and secure portals.

4. What to Look For in a Company

Regardless of whether you work with a provider, broker, or platform, prioritize companies with:

- Competitive Offers: They should consistently pay above-market rates.

- Licensing: Verify they are licensed in your state.

- Transparency: They should clearly explain their process and fees.

- Data Privacy: Protecting your sensitive information is essential.

5. Red Flags to Avoid

- Unlicensed Companies: These can expose you to fraud or insufficient protections.

- Hidden Fees: Always ask for a full fee breakdown before agreeing to sell.

- Pressure Tactics: A reputable company will never rush you into a decision.

The LS Hub Advantage

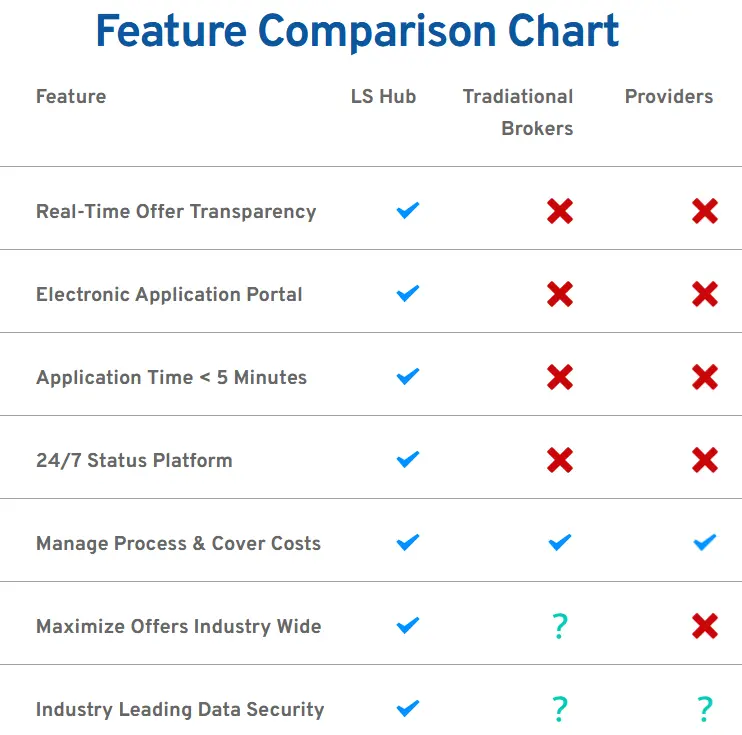

Navigating the life settlement process can feel overwhelming, but LS Hub simplifies it. Here’s why LS Hub is the ultimate solution for selling your life insurance policy:

- Maximum Value: LS Hub leverages advanced technology to create global competition among buyers, ensuring you receive the highest offer for your policy.

- Expert Guidance: Our team of life settlement specialists works with you every step of the way to provide clarity and confidence.

- Industry-Leading Privacy and Security: LS Hub uses state-of-the-art security measures to protect your personal information, ensuring it is never released to the public.

Selling your life insurance policy is a big decision. With LS Hub, you can feel confident you’re making the right choice. Try the LS Hub life settlement calculator and take the first step toward unlocking your policy’s value today.

Stephen Jass

My goal is to help maximize the end value of life insurance policies.

Stephen Jass, a recognized authority in the life settlement industry, has dedicated over a decade to transforming how life insurance policies are valued, sold, and managed. As the founder and CEO of LS Hub, Stephen has pioneered technology-driven platforms that ensure transparency, privacy, and maximum returns for policy owners. His expertise extends to collaborating with global investors, advancing regulatory understanding, and spearheading innovative strategies that redefine industry standards. Stephen's commitment to serving policy owners with integrity and providing unmatched value has positioned him as a trusted leader in this niche financial space.