Selling Your Term Life Insurance Policy in Hollis Crossroads

Can you sell your term life insurance policy in Hollis Crossroads? At LS Hub, we believe in providing policyholders with the information and tools they need to make informed decisions.

Whether you’re exploring the option to sell term life insurance, find the best company to sell your life insurance policy to, or simply want to know if selling is right for you, we’re here to guide you every step of the way.

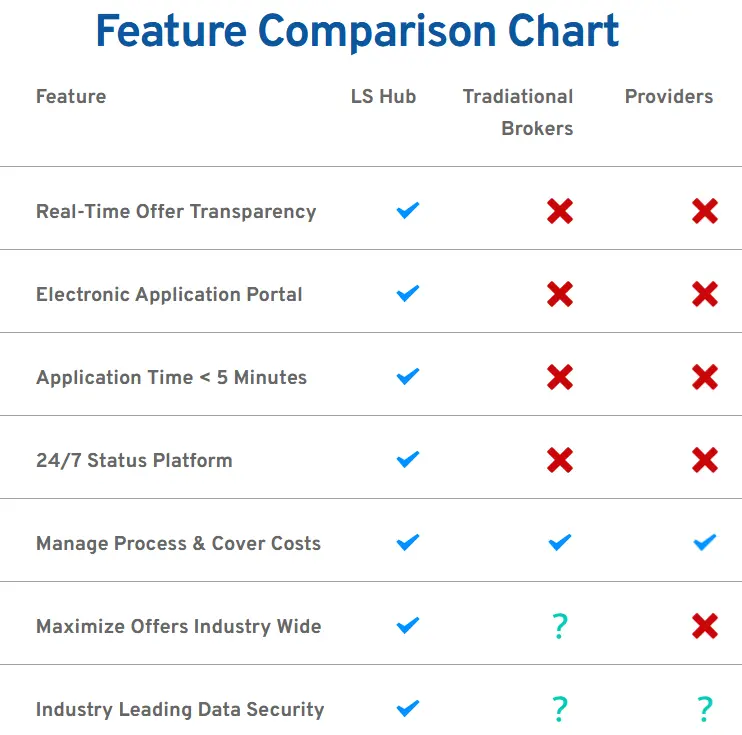

Our industry-leading technology ensures privacy and brings multiple buyers to the table, creating a transparent and efficient process designed to maximize your payout.