Selling Your Life Insurance Policy

Are you considering selling your life insurance policy? At LS Hub, we believe in providing policyholders with the information and tools they need to make informed decisions.

Whether you’re exploring the option to sell term life insurance, find the best company to sell your life insurance policy to, or simply want to know if selling is right for you, we’re here to guide you every step of the way.

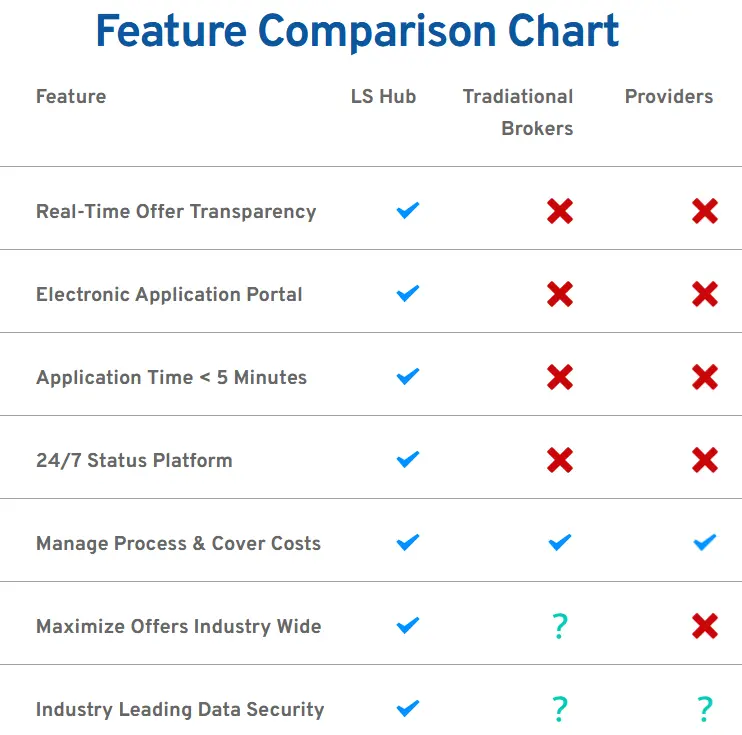

Our industry-leading technology ensures privacy and brings multiple buyers to the table, creating a transparent and efficient process designed to maximize your payout.

Quick Facts:

- Who Can Qualify: Primarily seniors aged 65+ or individuals with health impairments.

- Eligible Policies: Universal, whole, and convertible term life policies are the most common.

- Why It’s Done: Offers an alternative to letting a policy lapse or surrendering it for minimal value.

Why Choose LS Hub?

- Serve Not Sell: We’re here to serve, not sell. We understand that selling a life insurance policy is a deeply personal decision, often tied to significant life changes.

- Privacy: We set the gold standard for privacy in the life settlement industry; our platform eliminates unnecessary exposure.

- Competition: We foster secure competition among trusted buyers, ensuring the highest offer for your policy while keeping your personal information private and protected.

- Easy Process: Our streamlined process & technology simplifies every step, making it easy to navigate selling your policy with confidence and peace of mind.

Serve Not Sell

- We’re here to serve, not sell. We understand that selling a life insurance policy is a deeply personal decision, often tied to significant life changes.

Privacy

- We set the gold standard for privacy in the life settlement industry; our platform eliminates unnecessary exposure.

Competition

- We foster secure competition among trusted buyers, ensuring the highest offer for your policy while keeping your personal information private and protected.

Easy Process

- Our streamlined process & technology simplifies every step, making it easy to navigate selling your policy with confidence and peace of mind.

Why Sell My Life Insurance Policy?

- Maximize Policy Value: Life settlements allow you to receive more than the surrender value of your policy, making it an attractive option for policyholders who no longer need coverage.

- Financial Flexibility: Use the proceeds to cover healthcare expenses, pay off debt, or fund retirement.

- Sell Term Life Insurance: Yes, you can even sell a term life policy, provided it meets certain eligibility requirements.

Factors That Impact Policy Value

- Policy Face Value: Larger policies often result in higher payouts.

- Premium Costs: Lower premiums make policies more attractive to buyers.

- Health of the Insured: Shorter life expectancies typically lead to higher offers.

- Market Conditions: Demand for policies can influence payout ranges.

Policy Face Value

- Larger policies often result in higher payouts.

Premium Costs

- Lower premiums make policies more attractive to buyers.

Health of the Insured

- Shorter life expectancies typically lead to higher offers.

Market Conditions

- Demand for policies can influence payout ranges.

How Does a Life Settlement Work?

- 1) Consultation: Speak with an expert to determine eligibility and options.

- 2) Policy Review: Details about your policy and medical history are evaluated.

- 3) Auction*: Qualified buyers provide competitive bids based on your policy and health.

- 4) Close: Accept the best offer, sign the necessary paperwork, and receive payout.

1) Consultation

- Speak with an expert to determine eligibility and options.

2) Policy Review

- Details about your policy and medical history are evaluated.

3) Auction*

- Qualified buyers provide competitive bids based on your policy and health.

*You are never obligated to accept an offer and there is no cost to you.

Expected Payout for Selling Your Life Insurance

Try our Life Settlement Calculator to obtain an estimate of how much your policy could be worth. Keep in mind the best way to get a realistic value estimate for your policy is to speak to an expert.

Key Life Settlement Parties

- Policy Owner: The person or entity selling the policy.

- Insured: The individual(s) insured by the life insurance policy.

- Broker: The licensed entity facilitating the maximum value.

- Buyer: The investment fund purchasing the policy.

Benefits of Selling Life Insurance Policy

- Immediate Lump Sum: Turn your life insurance into a lump sum payment you can use right away.

- Avoid Policy Lapse: Instead of letting the policy expire, receive value for it.

- No Restrictions on Payout: Use the proceeds for medical bills, debt repayment, travel, or other needs.

- Eliminate Premiums: Relieve the financial burden of ongoing premiums.

Benefits of Selling Life Insurance Policy

Immediate Lump Sum

Turn your life insurance into a lump sum payment you can use right away.

Avoid Policy Lapse

Instead of letting the policy expire, receive value for it.

No Restrictions on Payout

Use the proceeds for medical bills, debt repayment, travel, or other needs.

Eliminate Premiums

Relieve the financial burden of ongoing premiums.

Who Qualifies to Sell Their Life Insurance Policy?

Eligibility Requirements:

- Seniors aged 65+ or individuals with health impairments.

- Policies with a face value of $100,000 or more.

- Policies in force over 2 years.

Risks and Considerations

- Loss of Death Benefit: Beneficiaries will no longer receive the policy’s payout.

- No Competition: Working with a direct buyer or non-expert can limit competition.

- Overshopping: Applying with too many companies can cause end-funds to not engage.

How to Choose the Best Company

- Licensing and Compliance: Ensure the company is licensed and regulated in your state.

- Competitive Offers: Choose a company that works with multiple buyers to maximize your payout.

- Transparency: Look for a company with clear fees and terms with real time offer updates.

Frequently Asked Questions

Most transactions take between 4–8 weeks from start to finish.

In most cases, proceeds are taxable, check out our article on life settlement taxation. Consult a tax professional for specific guidance.

Yes, convertible term policies may qualify for a life settlement.

Institutional investors and specialized funds are the primary buyers.

Yes, partial life settlements are an option. You can sell a portion of your policy while retaining some coverage for your beneficiaries, providing financial flexibility without fully relinquishing the death benefit.

Life settlement offers are typically higher than the policy’s cash surrender value but lower than the total death benefit. This makes them a better alternative to surrendering the policy if you no longer need coverage.

{{mpg_state}} regulates life settlement through {{mpg_regulation}} and is overseen by the {{authority}}.

News & Updates

Florida Life Settlement Guide: Maximize Your Policy’s Value

Unlock the full potential of your life insurance policy with...

Read More2025 Life Settlement Calculator: Fast & Accurate Valuation Tool

Discover the future of life settlements with the 2025 Life...

Read MoreHow LS Hub’s AI Enhances Investment Analysis in Life Settlements

Discover how LS Hub's cutting-edge AI technology is revolutionizing investment...

Read MoreTop Risks of Investing in Life Settlements (And How to Avoid Them)

Discover the hidden pitfalls of investing in life settlements and...

Read More